Telescopes in Japan #

While it is unclear exactly who invented the telescope, the earliest extant record of the device is a patent application filed in October of 1608 by Dutch glass maker Hans Lipperhey in the city of Middleburg. News of his design quickly spread through Europe, reaching Galileo in 1609, who then built an improved version and put it to the skies, publishing his early findings in his treatise Sidereus Nuncius (Starry Messenger) in 1610.

Hans Lipperhey’s original patent application for the telescope, which he described as a device ‘for seeing things far away as if they were nearby.'

Source.

Hans Lipperhey’s original patent application for the telescope, which he described as a device ‘for seeing things far away as if they were nearby.'

Source.

It was only three years later, in June of 1613, that the Clove, captained by John Saris, arrived at Hirado, as the first English ship to make port in Japan. Saris was sent by the East India Company with a letter and many gifts from King James, seeking to establish diplomatic and trade relations. Chief among these gifts was a large silver-gilt telescope, two meters long and adorned with gold—it was the first in Japan. Through a rather difficult journey, rounding the cape, the telescope had made it around the world in only five years!

Upon his arrival, Saris was met by William Adams, a fellow Englishman who had been living in Japan for over a decade. Adams had first arrived in the country in 1600 as part of a Dutch trading mission and had since risen to become a trusted advisor to the Shogun—Tokugawa Ieyasu. Together, Saris and Adams presented the telescope to Ieyasu in a grand ceremony, where it was received with great interest and curiosity, and Saris returned home having successfully set up a trading post at Hirado and gained trading privileges for the English.

Rice Futures and Sake #

A source from a century later, Bunryu Nishiki’s 1706 text “Kumagae Onna Amigasa,” recounts the story of a young man named Yomiji who was determined to break into the rice business, and in doing so made clever use of the telescope, pointing it not at the stars, but at markets. With his father’s backing, Yomiji established himself as a money changer in Koriyama, near Osaka, converting rice (a quasi-currency in Edo period Japan) into silver coin.

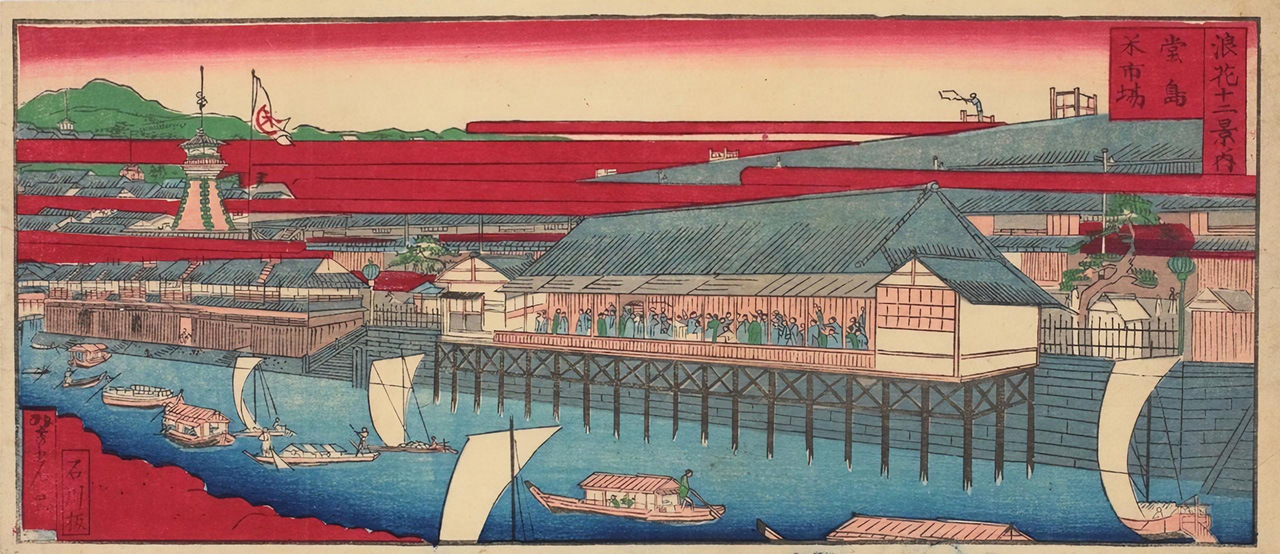

Osaka was the commercial capital of Japan at the time, and Dojima Island within the city had emerged as the center of the rice trade, hosting what many consider to be the world’s first organized futures exchange. Traders at Dojima bought and sold standardized contracts for the future delivery of rice, rather than trading physical rice on the spot. The market allowed merchants to lock in prices, manage risk, and speculate on the future price of the commodity.

The Dojima Rice Exchange also served as a hub for information exchange. Merchants gathered there to share knowledge about market conditions, crop yields, and weather patterns. This information, disseminated through a network of couriers and messengers, helped traders make informed decisions and contributed to the efficiency of the market. As trading volumes grew, the Dojima Rice Exchange became the primary price discovery mechanism for rice in Japan, effectively setting the price for the entire country.

Thus, if one could know that price ahead of time, profits were virtually assured. This insight was the essence of Yomiji’s scheme: he placed a messenger at the Dojima exchange to signal price movements by hand, and observed them through a telescope from miles away in Koriyama, allowing him to trade based on Dojima’s latest prices before the news reached his competitors.

As soon as Yomiji arrived at the wholesaler in Koriyama, he started a moneychanging business. In order to get information about daily prices at the rice exchange, Yomiji hired a regular express messenger (hikyaku) and another messenger. A minute after the rice exchange started the business of the day in Osaka, the [second] messenger wearing red hat and red gloves ran like a flying bird and arrived at Kuragari Pass. He stood by a landmark pine tree and tried to regain his breath. If he raised his left hand by 1 degree, it meant the rice price increased by 1 bu of silver. If he raised his right hand by 1 degree, it meant the rice price decreased by 1 bu of silver. His role was to inform Yomiji of the increases and decreases of rice prices. Yomiji saw the person’s signals from the second floor of the wholesale store using a telescope which had a range of 10 miles, and bought or sold rice taking these price changes into consideration. After that, Yomiji [publicly] dispatched the express messenger to Osaka to obtain the rice prices there. As Yomiji knew the rice prices earlier than anyone when the information was delivered to Kuragari Pass, there was not a single day that Yomiji did not make money. Other merchants had no idea about his scheme. They gave Yomiji the nickname “Forecasting Yomiji” and rice prices in Koriyama came to be greatly influenced by Yomiji’s transactions.

Yomiji’s apparent prescience earned him the moniker “forecasting Yomiji” among his competitors. Unaware of his methods, they nonetheless converged on the notion that Yomiji possessed some unique insight, which, in turn, influenced the price of rice in Koriyama.

Unfortunately, his scheme was undone when one day his messenger was waylaid by a friend and sake-drinking partner. Inebriated, the messenger botched the price signals, leading Yomiji to make a large and costly trade in the wrong direction.

One day, when the messenger was running to give Yomiji his signals, he met a merchant returning from the Yamato region by the name of Sogen Nakamachimaruya. . . . Sogen was in a good mood after having a few glasses of sake and he asked the messenger to have a few drinks with him. The messenger, feeling great after a few glasses of cold sake, recounted various stories he had heard during his 10-day stay in Osaka. . . . He had another two to three glasses of sake. The messenger then parted with Sogen, saying that he would treat Sogen in the future, and started to run again. The road was rough. . . . He was late. He made his best effort to run as fast as he could, swinging both his hands like a crab, but ended up arriving at the pine tree four hours later than planned, as 7–8 glasses of sake had broken his stride. Yomiji was waiting and waiting, sitting on the second floor of his wholesale store and constantly looking into his telescope. . . . Finally the messenger in a red hat and red gloves appeared and stood by the landmark pine tree. The 7–8 glasses of sake greatly affected his memory, and he did not recall whether he should raise his left hand or right hand. He tried hard to recall, but he could not remember anything. . . . Finally he raised his left hand by 6 degrees, and Yomiji bought 30,000 koku of rice, believing that the rice prices had increased by 6 bu of silver. . . Actually the rice price was down by 7–8 bu of silver on the day and the express messenger soon brought the news. . . . Yomiji realized he had made a losing transaction, but it was already too late. The loss cost him 24 kan (90kg) of silver.

(There is a lesson here, somewhere, perhaps about model risk—or sake intake.)

Race to $c$ #

Yomiji’s story reflects a broader historical trend: the drive to minimize information transmission time has long been a defining feature of financial markets—a race to zero. Traders have long sought ways to gain an edge by accessing and acting upon market-moving information faster than their competitors:

In the 1770s, British banker Alexander Fordyce profited greatly by shorting East India Company stock on early reports of the Boston Tea Party, well before word of the colonial uprising reached London and sent shares falling.

When Reuters founded his agency in Aachen, he initially used carrier pigeons to quickly transmit news to and from Brussels. The pigeon network was soon replaced by the revolutionary telegraph, enabling much quicker dissemination of market prices over long distances. The construction of transcontinental and transatlantic telegraph lines further accelerated the flow of information, reducing communication times between Europe and North America from days to mere minutes.

More recently, with the advent of computerized trading systems, trading firms have invested significantly in cutting-edge network infrastructure to reduce latencies. Hundreds of millions of dollars have been invested in laying down and straightening fiber optic cables, as well as in setting up microwave towers between financial centers. Laser networks and even shortwave radio have also been reportedly used, the latter causing controversy among HAM Radio enthusiasts—a battle for the airwaves. And finding themselves limited by the speed of light in traditional fiber optic cables, firms have moved to hollow-core fiber, through which light travels 50% faster than solid glass.

Nevertheless, there are limitations. In 1905, Einstein published his seminal paper “On the Electrodynamics of Moving Bodies,” in which he laid out the foundation of the special theory of relativity. The theory was built upon two postulates:

- The laws of physics have the same form in all inertial reference frames.

- The speed of light in a vacuum is constant in all inertial reference frames, at $c \approx 3 \times 10^8$ m/s.

The first postulate is a generalization of Galileo’s principle of relativity, which stated that the laws of mechanics are the same in all inertial frames. Einstein extended this to all the laws of physics, including electromagnetism. The second postulate, however, was a radical departure from classical physics, and changed the classical conception of space and time.

(1)As Minkowski put it:

“Henceforth space by itself, and time by itself, are doomed to fade away into mere shadows, and only a kind of union of the two will preserve an independent reality.”

A limit on the speed of light in a vacuum is also a limit on the speed of information, and more broadly a limit on the speed of causality. A constraint to which both Yomiji peering into his telescope in feudal Japan, and the algorithms trading today, are beholden. Thus, what has often been described as a race to zero is perhaps better described as a race to $c$. Of course, for much of human history, the speed of trade was far from $c$, but recent advances have brought us much closer, and this has some consequences.

For one, the notion of absolute time, which we more or less assume in day-to-day life, becomes more troubling to bear. In special relativity, an event is defined as a point in four-dimensional spacetime, specified by three spatial coordinates and one time coordinate. The time coordinate is not absolute, but depends on the reference frame of the observer. In particular, events that are simultaneous in one frame of reference may not be simultaneous in another frame that is moving relative to the first.

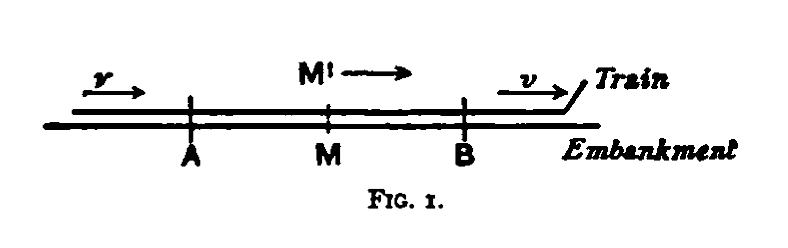

Einstein illustrated this with a thought experiment. Imagine a very long train traveling at a constant velocity along a railway embankment. Two lightning bolts strike the embankment at two distant points, A and B, just as the front and back of the train are passing by those points respectively.

From the perspective of an observer on the embankment, equidistant from A and B, the two lightning strikes are simultaneous. However, from the perspective of an observer on the train, the lightning strike at B (at the front of the train) will be perceived to have occurred before the strike at A (at the back). This is because the train is moving towards the light coming from B and away from the light coming from A. Thus, the light from B will reach the observer on the train before the light from A does, leading them to conclude that the events were not simultaneous.

Einstein then pronounces the death of simultaneity:

“Events which are simultaneous with reference to the embankment are not simultaneous with respect to the train, and vice versa (relativity of simultaneity). Every reference body (coordinate system) has its own particular time; unless we are told the reference body to which the statement of time refers, there is no meaning in a statement of the time of an event.”

Without a notion of absolute time, i.e., without any kind of master clock, we no longer have an absolute timestamp, and so there are legal ambiguities with the enforcement of financial regulations. For instance, “trade-through” rules, which prevent brokers from executing orders at prices worse than those available on other exchanges, hinge on the ability to verify the timing of trades across multiple venues. But without synchronized timestamps, in what sense is compliance even determined?

If different observers see different event orders, how can regulators enforce compliance? Would lawyers need to argue relativistically, accounting for the defendant’s particular frame of reference? “Your honor, in the reference frame of my client’s microwave tower, the trades were perfectly legal.“

(2)An interesting example of this kind of analysis came in September 2013, when Nanex, a market data service provider, uncovered evidence of what they called the “Great Fed Robbery.”

Nanex analyzed the time-stamps of trades in both Chicago and New York at the millisecond level, and found that the two markets reacted to a Fed announcement simultaneously. But that would be a physical impossibility if the information was released from the Fed’s lock-up room in Washington D.C., as the information would take a few milliseconds to travel to Chicago and New York, and would hit the closer New York markets first.

Information takes about 7ms to travel between Chicago and D.C., and about 2ms between New York and D.C. So if the news was released in Washington, we’d expect to see the New York markets react about 5ms before the Chicago markets. Instead, they reacted at the same time.

So they concluded that the Fed announcement had been leaked early. They proposed that either (i) a news organization pre-released the announcement to servers near the exchanges, or what they deemed the more likely case (ii) the news was leaked to a high-frequency trading firm that had pre-programmed their algorithms.

The precise timing of the trading burst, just 1ms after 2pm, was especially suspicious. News organizations sometimes release information around 15ms before or after the official time. But this was quicker—as if someone knew exactly when the announcement was coming, and was ready to trade on it immediately.

Though I suppose it was nice of them to wait!

Let’s leave that to the regulators.

Midpoint Colocation #

Beyond such headaches, are opportunities for “relativistic arbitrage.” A common practice for high speed trading firms is to colocate their servers and equipment at the site of an exchange’s servers, near the matching engine, to minimize the distance (and therefore latency) as much as possible. But suppose you have two exchanges located some distance apart and you want to compare prices between them for arbitrage opportunities.

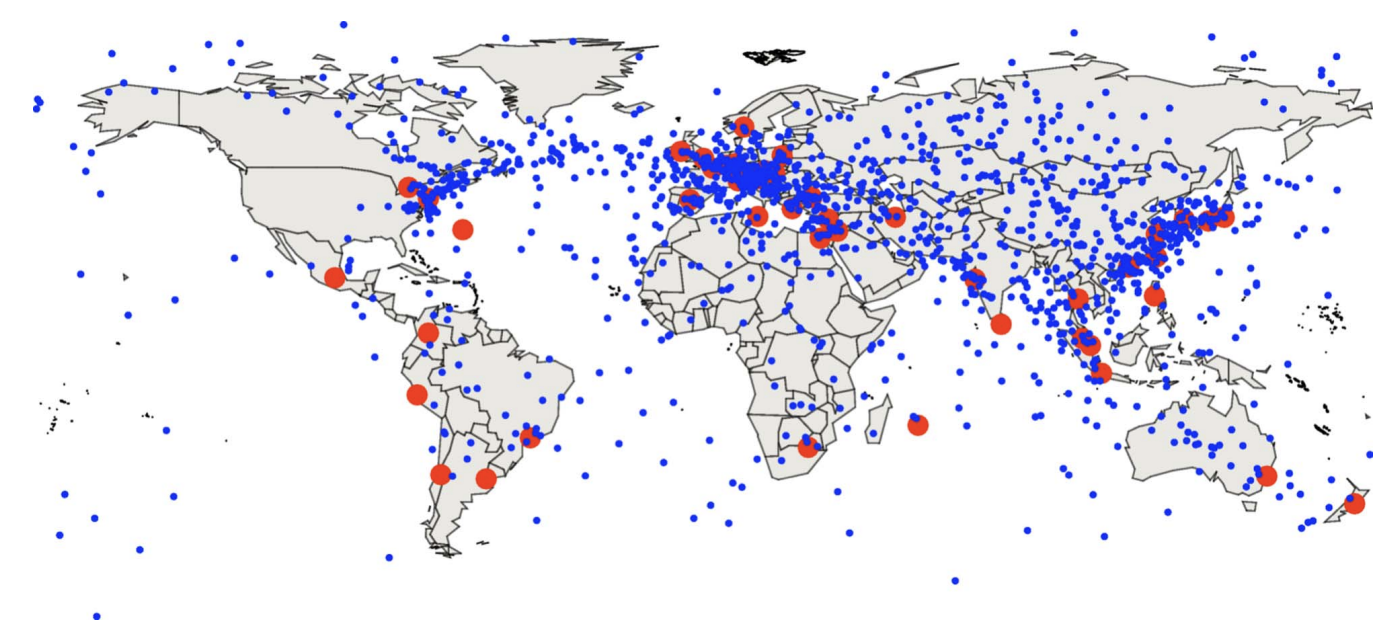

One proposed solution, first suggested in a 2010 paper by Wissner-Gross and Freer, is to place your servers at the geographical midpoint between the two exchanges—so called midpoint colocation. This takes advantage of the natural information advantage due to the halved distance to each exchange, which becomes pronounced at relativistic speeds.

Let’s say the two exchanges are separated by a distance $d$. If you have your server colocated at one of the exchanges, it will take a time $\frac{d}{c}$ for price information from the other exchange to reach you. Then, if you spot an arbitrage opportunity, it will take another $\frac{d}{c}$ for your order to reach the other exchange. So the total round trip time for price comparison and execution is $\frac{2d}{c}$.

Now, if instead you put your server at the midpoint between the two exchanges, price information from each exchange only needs to travel half the distance $\frac{d}{2}$. So it will arrive in half the time, $\frac{d}{2c}$. If you spot an arbitrage opportunity, your orders also only need to travel half the distance to each exchange. So the total roundtrip time for price comparison and execution is now $\frac{d}{2c} + \frac{d}{2c} = \frac{d}{c}$. That’s half of what it would be with single exchange colocation.

Wissner-Gross and Freer use this insight to calculate optimal intermediate locations between major global exchanges—though in a more sophisticated manner. They even map out ‘hotspots’ across the Earth’s surface that would provide the maximum latency advantage for ‘relativistic arbitrage’ between each pair of exchanges. The paper generated some excitement, and a subsequent article in Nature imagines a rather peculiar future where the Atlantic is riddled with trading platforms:

“In the future, when airborne laser networks span the oceans, things may get even stranger. The location at which traders get the earliest possible information from two exchanges lies at their midpoint between Chicago and London, but this is in the middle of the Atlantic Ocean. At such a site, traders could exploit a technique called ‘relativistic arbitrage’ to profit from momentary imbalances in prices in Chicago and London.”

However, the actual reality of midpoint colocation is more nuanced, and there are serious limitations to its efficacy, as discussed by Howorka and Haug. There three main colocations examined: (single) exchange colocation, midpoint colocation, and twin exchange colocation, where there is colocation at both exchanges.

As discussed above, midpoint colocation is faster than single exchange colocation for trading between two exchanges, but it is not faster than twin exchange colocation. For comparing prices, midpoint colocation provides a theoretical latency advantage, as it halves the distance information must travel from each exchange. But this advantage only applies to price comparison. For actually executing trades based on that price information, midpoint colocation offers no advantage over twin exchange colocation.

With twin exchange colocation, a trader has servers colocated at each of the two exchanges, and so can compare prices between the two exchanges in time $\frac{d}{c}$ and then execute trades immediately at each exchange. The total roundtrip time for price comparison and execution is thus also $\frac{d}{c}$, same as for midpoint colocation. Moreover, with twin exchange colocation you have the added benefit of being able to trade locally immediately, where midpoint colocation would require information to travel the full distance to the midpoint and back.

Nonetheless, midpoint colocation may be of some practical use in certain circumstances, say when it becomes cheaper to build a trading platform in the middle of the Atlantic than to pay for colocation at exchanges, or when the exchanges are not willing to provide colocation services. Or perhaps, if we are a little imaginative, when the exchanges are on different planets. (3)Delay from Earth to Mars is around 3-22 minutes depending on their respective positions in orbit, which is much more significant than any terrestrial delay. So perhaps it would become more meaningful.

For now, the idea remains more of a thought experiment, and a reminder of the physical constraints that keep us honest.

References

[1] Angel, J. J. (2014). When finance meets physics: The impact of the speed of light on financial markets and their regulation. The Financial Review, 49(2), 271-281.

[2] Buchanan, Mark. 2015. “Physics in Finance: Trading at the Speed of Light.” Nature 518 (7538): 161–63.

[3] Einstein, A. (1920). Relativity: The special and general theory (R. W. Lawson, Trans.). Henry Holt and Company. (Original work published 1916).

[4] Haug, E. G. (2018). Double light speed: History, confusion, and recent applications to high speed trading. SSRN. https://ssrn.com/abstract=3127662.

[5] Howorka, E. (2015). Colocation beats the sol. http://edhoworka.com/colocation-beats-the-sol/.

[6] Markham, J. W. (2015). High-speed trading on stock and commodity markets—From courier pigeons to computers. San Diego Law Review, 52, 555-618.

[7] Moss, D. A., & Kintgen, E. (2009). The Dojima rice market and the origins of futures trading. Harvard Business School Case 709-044. (Revised November 2010).

[8] Nanex. (2013). The great Fed robbery. http://www.nanex.net/aqck2/4436.html.

[9] Nishiki, B. (1706). Kumagae Onna Amigasa (Kumagae lady’s hat). Translated by Mayuka Yamazaki. Referenced in The Dojima rice market and the origins of futures trading.

[10] Wissner-Gross, A. D., & Freer, C. E. (2010). Relativistic statistical arbitrage. Physical Review E, 82(5), 056104.